http://www.abc.com/20251231#AccountingStandardsUpdate20XXX1Memberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX1Memberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX2Memberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX3Memberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX3Memberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX3RetrospectiveMemberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX1Memberhttp://www.abc.com/20251231#IncorrectCalculationOfDepreciationMemberhttp://www.abc.com/20251231#DiscontinuedOperationsMemberhttp://www.abc.com/20251231#MisapplicationOfGAAPMemberhttp://www.abc.com/20251231#DiscontinuedOperationsMemberhttp://www.abc.com/20251231#MisapplicationOfGAAPMemberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX6Memberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX6RetrospectiveMemberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX7Memberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX7ModifiedRetrospectiveMemberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX8Memberhttp://www.abc.com/20251231#AccountingStandardsUpdate20XXX8RetrospectiveMemberiso4217:USDiso4217:USDxbrli:shares01234567892025-01-012025-12-310123456789srt:ScenarioPreviouslyReportedMemberus-gaap:CommonStockMember2022-12-310123456789srt:ScenarioPreviouslyReportedMemberus-gaap:AdditionalPaidInCapitalMember2022-12-310123456789srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2022-12-310123456789srt:ScenarioPreviouslyReportedMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310123456789srt:ScenarioPreviouslyReportedMemberus-gaap:NoncontrollingInterestMember2022-12-310123456789srt:ScenarioPreviouslyReportedMember2022-12-3101234567892022-01-012022-12-310123456789srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMemberus-gaap:RetainedEarningsMember2022-12-310123456789srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310123456789srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember2022-12-310123456789us-gaap:CommonStockMember2022-12-310123456789us-gaap:AdditionalPaidInCapitalMember2022-12-310123456789us-gaap:RetainedEarningsMember2022-12-310123456789us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310123456789us-gaap:NoncontrollingInterestMember2022-12-3101234567892022-12-310123456789us-gaap:CommonStockMember2024-12-310123456789us-gaap:AdditionalPaidInCapitalMember2024-12-310123456789us-gaap:RetainedEarningsMember2024-12-310123456789us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310123456789us-gaap:NoncontrollingInterestMember2024-12-3101234567892024-12-3101234567892024-01-012024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommonStockMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AdditionalPaidInCapitalMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:RetainedEarningsMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:NoncontrollingInterestMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2024-12-3101234567892025-12-3101234567892023-01-012023-12-310123456789srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember2024-01-012024-12-310123456789srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember2023-01-012023-12-3101234567892025-01-010123456789srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:RetainedEarningsMember2022-12-310123456789srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-12-310123456789us-gaap:RetainedEarningsMember2023-01-012023-12-310123456789us-gaap:NoncontrollingInterestMember2023-01-012023-12-310123456789us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310123456789us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310123456789us-gaap:CommonStockMember2023-12-310123456789us-gaap:AdditionalPaidInCapitalMember2023-12-310123456789us-gaap:RetainedEarningsMember2023-12-310123456789us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310123456789us-gaap:NoncontrollingInterestMember2023-12-3101234567892023-12-310123456789us-gaap:RetainedEarningsMember2024-01-012024-12-310123456789us-gaap:NoncontrollingInterestMember2024-01-012024-12-310123456789us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310123456789us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310123456789abc:AccountingStandardsUpdate20XXX4Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberabc:AccountingStandardsUpdate20XXX4Member2024-12-310123456789abc:AccountingStandardsUpdate20XXX5Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2024-12-310123456789abc:AccountingStandardsUpdate20XXX5Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberabc:AccountingStandardsUpdate20XXX5Member2024-12-310123456789us-gaap:RetainedEarningsMember2025-01-012025-12-310123456789us-gaap:NoncontrollingInterestMember2025-01-012025-12-310123456789us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-12-310123456789us-gaap:AdditionalPaidInCapitalMember2025-01-012025-12-310123456789us-gaap:CommonStockMember2025-12-310123456789us-gaap:AdditionalPaidInCapitalMember2025-12-310123456789us-gaap:RetainedEarningsMember2025-12-310123456789us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-12-310123456789us-gaap:NoncontrollingInterestMember2025-12-310123456789srt:ScenarioPreviouslyReportedMember2024-01-012024-12-310123456789srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2024-01-012024-12-310123456789srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2024-01-012024-12-310123456789srt:ScenarioPreviouslyReportedMember2023-01-012023-12-310123456789srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-01-012023-12-310123456789srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-01-012023-12-310123456789srt:ScenarioPreviouslyReportedMember2024-12-310123456789srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2024-12-310123456789srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2024-12-310123456789srt:ScenarioPreviouslyReportedMember2023-12-310123456789srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2023-12-310123456789srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-12-310123456789srt:ProFormaMember2026-01-012026-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMembersrt:MinimumMembersrt:ProFormaMemberus-gaap:RetainedEarningsMember2026-12-310123456789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMembersrt:MaximumMembersrt:ProFormaMemberus-gaap:RetainedEarningsMember2026-12-310123456789srt:ProFormaMember2026-01-010123456789srt:ProFormaMember2026-12-310123456789srt:ProFormaMember2025-01-012025-12-310123456789srt:ProFormaMember2024-01-012024-12-310123456789us-gaap:ChangeInReportingEntityAdjustmentMember2024-01-012024-12-310123456789us-gaap:ChangeInReportingEntityAdjustmentMember2023-01-012023-12-310123456789us-gaap:EquipmentMember2024-12-310123456789us-gaap:EquipmentMember2025-12-310123456789us-gaap:ServiceLifeMemberus-gaap:EquipmentMember2025-12-310123456789us-gaap:CustomerContractsMember2024-12-310123456789us-gaap:CustomerContractsMember2025-12-310123456789us-gaap:IntangibleAssetsAmortizationPeriodMemberus-gaap:CustomerContractsMember2025-12-310123456789abc:ServiceLifeAndIntangibleAssetsAmortizationPeriodMember2025-01-012025-12-310123456789us-gaap:ServiceLifeMember2025-01-012025-12-310123456789us-gaap:IntangibleAssetsAmortizationPeriodMember2025-01-012025-12-310123456789abc:ServiceLifeAndIntangibleAssetsAmortizationPeriodMemberus-gaap:EquipmentMember2025-12-310123456789abc:ServiceLifeAndIntangibleAssetsAmortizationPeriodMemberus-gaap:CustomerContractsMember2025-12-31

Version 4.0

April 2025

Accounting Changes

(2025 GAAP Taxonomy*)

GAAP Financial Reporting Taxonomy and SEC Reporting Taxonomy (collectively referred to as the “GAAP Taxonomy”)

Implementation Guide Series

* Changes from the 2024 GAAP Taxonomy Implementation Guide are included in Appendix A.

The GAAP Taxonomy Implementation Guide is not authoritative; rather, it is a document that communicates how the GAAP Financial Reporting Taxonomy and the SEC Reporting Taxonomy (collectively referred to as the “GAAP Taxonomy”) are designed. It also provides other information to help a user of the GAAP Taxonomy understand how elements and relationships are structured.

| | |

| Copyright © 2025 by Financial Accounting Foundation. All rights reserved. Permission is granted to make copies of this work provided that such copies are for personal or intraorganizational use only and are not sold or disseminated and provided further that each copy bears the following credit line: “Copyright © 2025 by Financial Accounting Foundation. All rights reserved. Used by permission.” |

GAAP Taxonomy Implementation Guide on Accounting Changes

Overview

The purpose of this Guide is to demonstrate the modeling for the reporting of the transition upon adoption of amendments from an Accounting Standards Update (ASU) or other accounting changes under FASB Accounting Standards Codification® Topic 250, Accounting Changes and Error Corrections, and Topics amended by an ASU. These examples are not intended to encompass all the potential modeling configurations or to dictate the appearance and structure of an entity’s extension taxonomy or its financial statements. The examples are provided to help users of the GAAP Taxonomy understand how the modeling for the reporting of the transition upon adoption of amendments from an ASU or other accounting changes is structured within the GAAP Taxonomy. The examples are based on the assumption that the entity meets the criteria for reporting the transition upon adoption of amendments from an ASU or other accounting changes under Generally Accepted Accounting Principles (GAAP) and/or U. S. Securities and Exchange Commission (SEC) authoritative literature. In addition, the reported line items within the examples do not include all reporting requirements and represent only partial disclosures and statements for illustrative purposes.

While constituents may find the information in the Guide useful, users looking for guidance to conform to SEC eXtensible Business Reporting Language (XBRL) filing requirements should look to the SEC EDGAR Filer Manual and other information provided on the SEC’s website at www.sec.gov/structureddata. This Guide focuses on detail tagging only (Level 4); it does not include elements for text blocks, policy text blocks, and table text blocks (Levels 1 through 3).

Two sections are included in this Guide:

•Section 1: Overview of Modeling: This section provides an overview of the modeling for the reporting of the transition upon adoption of amendments from an ASU or other accounting changes.

•Section 2: Examples of Modeling: This section includes examples of modeling for the reporting of the transition upon adoption of amendments from an ASU or other accounting changes.

General Information

(1)A legend for dimensions and domain members has been provided to associate with facts contained in the notes to financial statements. Extension elements are coded using “Ex.” Legends specific to the examples are provided in Figure x.2 of each example.

| | | | | | | | |

| Coding | Standard Label | Element Name |

| A1 | Equity Components [Axis] | StatementEquityComponentsAxis |

| Equity Component [Domain] | EquityComponentDomain |

| M1 | Common Stock [Member] | CommonStockMember |

| M2 | Additional Paid-in Capital [Member] | AdditionalPaidInCapitalMember |

| M3 | Retained Earnings [Member] | RetainedEarningsMember |

| M4 | AOCI Attributable to Parent [Member] | AccumulatedOtherComprehensiveIncomeMember |

| M5 | Noncontrolling Interest [Member] | NoncontrollingInterestMember |

| | |

| A2 | Revision of Prior Period [Axis] | RestatementAxis |

| Revision of Prior Period [Domain] | RestatementDomain |

| M6 | Previously Reported [Member] | ScenarioPreviouslyReportedMember |

| Revision of Prior Period, Adjustment [Member] | RestatementAdjustmentMember |

| M7 | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember |

| M8 | Revision of Prior Period, Error Correction, Adjustment [Member] | RevisionOfPriorPeriodErrorCorrectionAdjustmentMember |

| M9 | Revision of Prior Period, Reclassification, Adjustment [Member] | RevisionOfPriorPeriodReclassificationAdjustmentMember |

| M10 | Change in Reporting Entity, Adjustment [Member] | ChangeInReportingEntityAdjustmentMember |

| | |

| A3 | Cumulative Effect, Period of Adoption [Axis] | CumulativeEffectPeriodOfAdoptionAxis |

| Cumulative Effect, Period of Adoption [Domain] | CumulativeEffectPeriodOfAdoptionDomain |

| M11 | Cumulative Effect, Period of Adoption, Adjustment [Member] | CumulativeEffectPeriodOfAdoptionAdjustmentMember |

| M12 | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember |

| | |

| A4 | Accounting Standards Update [Axis] | AdjustmentsForNewAccountingPronouncementsAxis |

| Accounting Standards Update [Domain] | TypeOfAdoptionMember |

| M13 | Accounting Standards Update 20XX-X4 [Member] | AccountingStandardsUpdate20XXX4Member |

| M14 | Accounting Standards Update 20XX-X5 [Member] | AccountingStandardsUpdate20XXX5Member |

| | |

| A5 | Scenario [Axis] | StatementScenarioAxis |

| Scenario [Domain] | ScenarioUnspecifiedDomain |

| M15 | Pro Forma [Member] | ProFormaMember |

| | |

| A6 | Statistical Measurement [Axis] | RangeAxis |

| Statistical Measurement [Domain] | RangeMember |

| M16 | Minimum [Member] | MinimumMember |

| M17 | Maximum [Member] | MaximumMember |

| | |

| A7 | Long-Lived Tangible Asset [Axis] | PropertyPlantAndEquipmentByTypeAxis |

| Long-Lived Tangible Asset [Domain] | PropertyPlantAndEquipmentTypeDomain |

| M18 | Equipment [Member] | EquipmentMember |

| | | | | | | | |

| Coding | Standard Label | Element Name |

| A8 | Finite-Lived Intangible Assets by Major Class [Axis] | FiniteLivedIntangibleAssetsByMajorClassAxis |

| Finite-Lived Intangible Assets, Major Class Name [Domain] | FiniteLivedIntangibleAssetsMajorClassNameDomain |

| M19 | Customer Contracts [Member] | CustomerContractsMember |

| | |

| A9 | Effect of Change in Accounting Estimate, Type [Axis] | ChangeInAccountingEstimateByTypeAxis |

| Effect of Change in Accounting Estimate, Type [Domain] | ChangeInAccountingEstimateTypeDomain |

| M20 | Service Life [Member] | ServiceLifeMember |

| M21 | Intangible Assets, Amortization Period [Member] | IntangibleAssetsAmortizationPeriodMember |

| ExM22 | Service Life and Intangible Assets, Amortization Period [Member] | ServiceLifeMemberAndIntangibleAssetsAmortizationPeriodMember |

(2)Elements that have an instant period type and elements that have a duration period type are indicated as such in Figure x.2 of each example. Instant elements have a single date context (such as December 31, 20XX) and duration elements have a starting and ending date as their context (such as January 1 through December 31, 20XX).

(3)The XBRL report view (Figure x.3 in each example) does not include all information that may appear in an entity’s instance document. The XBRL report view is provided for illustrative purposes only.

(4)For elements contained in the GAAP Taxonomy, the standard label is as it appears in the GAAP Taxonomy. For extension elements, the standard label corresponds to the element name. For information about structuring extension elements, refer to the SEC EDGAR Filer Manual.

(5)Values reported in XBRL are generally entered as positive, with the exception of certain concepts such as net income (loss) or gain (loss).

(6)Preferred labels (Figure x.3 in each example) are the labels created and used by an entity to show the line-item captions in its financial statements.

(7)Additional information for values reported using extensible enumerations can be found in the GAAP Taxonomy Implementation Guide, Extensible Enumerations: A Guide for Preparers.

Section 1: Overview of Modeling

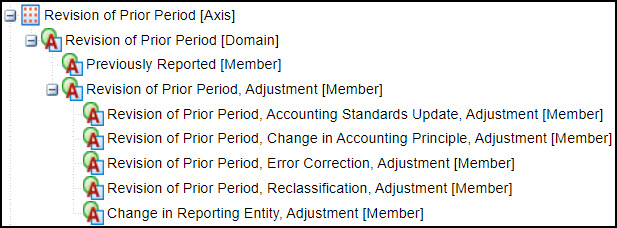

The “Revision of Prior Period [Axis]” (A2) is modeled with the “Previously Reported [Member]” (M6) and members for each type of adjustment that may revise a prior-period amount and a member that represents all revisions to a prior period:

“Revision of Prior Period, Adjustment [Member]” and “Revision of Prior Period, Change in Accounting Principle, Adjustment [Member]” are not used to tag values in the examples. They are used to provide a relationship in order for consumers of the data to better understand what these member elements represent.

This modeling is intended to result in the revised amount representing the report-wide value for the context and allows for multiple types of revisions to prior periods to be reported in the same filing for the same line item.

There are corresponding dimension and extensible enumeration elements to provide additional information for the reason for the revision. The dimension elements are intended to be used when the type of revision is further disaggregated, and the extensible enumeration element is intended to be used when there is only one type of revision for each adjustment in the same reporting date context. The dimension elements are:

•“Accounting Standards Update [Axis]” (A4)

•“Change in Accounting Principle, Type [Axis]”

•“Error Correction, Type [Axis]”

•“Reclassification, Type [Axis]”

The extensible enumeration elements are:

•“Accounting Standards Update [Extensible Enumeration]” (XL2)

•“Change in Accounting Principle, Type [Extensible Enumeration]”

•“Error Correction, Type [Extensible Enumeration]” (XL20)

•“Reclassification, Type [Extensible Enumeration]” (XL21)

The “Revision of Prior Period, Reclassification, Adjustment [Member]” (M9) is intended to be used for reclassifications that affect comparability that are not related to an amendment from an ASU. Certain amendments from ASUs may contain reclassifications, but “Revision of Prior Period, Accounting Standards Update, Adjustment [Member]” (M7) is intended to be used for revisions of prior periods that are from amendments from ASUs.

There are two dimensions for the adjustments for amendments from ASUs: the “Revision of Prior Period [Axis]” (A2) and the “Cumulative Effect, Period of Adoption [Axis]” (A3). The “Revision of Prior Period [Axis]” (A2) is used for retrospective application when the prior periods are revised. The “Cumulative Effect, Period of Adoption [Axis]” (A3) is used for amendments from ASUs when the cumulative effect adjusts the opening balance of line items in the period of adoption and does not revise prior periods.

The date context used with the “Revision of Prior Period [Axis]” (A2) is the ending date context of the period prior to earliest period reported (earliest opening balance reported). For example, if the earliest period reported begins with 01/01/20X2 or ending of prior period of 12/31/20X1, the date context used for the values tagged with the “Previously Reported [Member]” (M6) and the “Revision of Prior Period, Accounting Standards Update, Adjustment [Member]” (M7) is 12/31/20X1.

The date context used with “Cumulative Effect, Period of Adoption [Axis]” (A3) and “Cumulative Effect, Period of Adoption, Adjustment [Member]” (M11) is the ending date context prior to the period of adoption. For example, if the period of adoption is 01/01/20X4, the date context used for the values tagged with “Cumulative Effect, Period of Adoption, Adjustment [Member]” (M11) and “Cumulative Effect, Period of Adoption, Adjusted Balance [Member]” (M12) is 12/31/20X3.

The two types of transition methods (retrospective application and cumulative effect in the period of adoption), which result in adjustments of values reported, are modeled similarly but need to be on two different dimensions because of how the adjustments affect the statements. For retrospective application, the prior periods are revised, and the adjusted values are the report-wide values in the context. For the cumulative effect in the period of adoption, the prior periods are not revised, and the values for the period prior to adoption remain the report-wide value in the context. The figure below illustrates this difference:

| | | | | | | | | | | | | | | | | | | | |

| Retrospective Application | | Cumulative Effect in the Period of Adoption |

| | | | | | |

| $100 | | Previously Reported [Member] | | $100 | | Report-wide value |

| 10 | | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | 10 | | Cumulative Effect, Period of Adoption, Adjustment [Member] |

| $110 | | Report-wide value | | $110 | | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] |

| | | | | | |

Users of machine-readable data have indicated that certain textual transition information about amendments from ASUs is valuable and elements have been added to better structure this information. These elements include:

•“Change in Accounting Principle, Accounting Standards Update, Adopted [true false]” (XL39)—structured as a Boolean data type and intended to be used if the amendment from the ASU is adopted upon its effective date.

•“Change in Accounting Principle, Accounting Standards Update, Early Adoption [true false]” (L23)—structured as a Boolean data type and intended to be used if the amendment from the ASU is adopted earlier than the effective date.

•“Change in Accounting Principle, Accounting Standards Update, Adoption Date” (L22)—structured as a date data type and is intended to be used to provide the date that the amendment from the ASU was adopted.

•“Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration]” (XL24)—structured as an extensible enumeration and is intended to be used when there is a choice in transition methods for the amendment from the ASU. The values for this element are members that are created for those amendments from ASUs that have a choice in method.

For the expected impacts of amendments from ASUs, the modeling is consistent for the two types of transition methods (retrospective application and cumulative effect in the period of adoption), and the “Scenario [Axis]” (A5) and the “Pro Forma [Member]” (M15) are used for both. In addition, this modeling for the expected impacts of amendments from ASUs is consistent with the modeling for actual impacts of amendments from ASUs with the main difference being the use of the “Scenario [Axis]” (A5) and the “Pro Forma [Member]” (M15). When the impact amounts are actual, that axis and member are no longer needed.

For the effects from a change in reporting entity, the dimensional modeling includes the use of “Revision of Prior Period [Axis]” (A2) and “Change in Reporting Entity, Adjustment [Member]” (M10) with the financial statement line item. In addition, this modeling includes a Boolean element to indicate a change in reporting entity—“Change in Reporting Entity [true false]” (L30).

For the effects from a change in accounting estimate, the dimensional modeling includes the use of “Effect of Change in Accounting Estimate, Type [Axis]” (A9) with the financial statement line item for the current reporting date context (i.e., the date context in which the change in accounting estimate occurs). In addition, this modeling includes a Boolean element to indicate a change in accounting estimate—“Change in Accounting Estimate, Occurred [true false]” (L36). If there is no effect shown in a particular disclosure and for example only the prior period and the current period default values are included, then the “Effect of Change in Accounting Estimate, Type [Axis]” (A9) is not intended to be used as no effect is disclosed.

Section 2: Examples of Modeling

This section provides examples of disclosures for accounting changes, error corrections, reclassifications, and change in reporting entity for comparability.

Example 1—Retrospective Effect on Statement of Stockholders' Equity for Each Individual Prior Period Balance Presented

This example provides an excerpt of a Statement of Stockholders' Equity to illustrate the modeling for the values for transition adjustments to retained earnings and accumulated other comprehensive income (AOCI) for application to the earliest period presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Consolidated Statements of Shareholders’ Equity | |

| (in thousands) | | | | | | | | | | | | | | |

| | | A1:M1 | | A1:M2 | | A1:M3 | | A1:M4 | | A1:M5 | | | |

| | | Common stock | | Additional paid-in capital | | Retained Earnings | | Accumulated other comprehensive (loss) income | | Noncontrolling interest | | Total | |

| Balance at December 31, 20X0 | | L1, A2:M6 | $ | 1,000 | | | $ | 840,000 | | | $ | 1,703,715 | | | $ | (106,400) | | | $ | (10,000) | | | $ | 2,428,315 | | |

| Adoption of ASU 20XX-X1 | [1] | L1, A2:M7 | | | | | (15,000) | | | (25,000) | | | | | (40,000) | | |

| Adjusted Balance at December 31, 20X0 | | L1 | $ | 1,000 | | | $ | 840,000 | | | $ | 1,688,715 | | | $ | (131,400) | | | $ | (10,000) | | | $ | 2,388,315 | | |

| |

| | | | | | | | | | | | | | |

_____________________________

Legend†:

†This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] XL2

Figure 1.1

The legend for the elements used to tag these facts follows:

| | | | | | | | | | | | | | |

| Standard Label | Balance Type | Period Type | Element Name |

| A1 | Equity Components [Axis] | | Duration | StatementEquityComponentsAxis |

| Equity Component [Domain] | | Duration | EquityComponentDomain |

| M1 | Common Stock [Member] | | Duration | CommonStockMember |

| M2 | Additional Paid-in Capital [Member] | | Duration | AdditionalPaidInCapitalMember |

| M3 | Retained Earnings [Member] | | Duration | RetainedEarningsMember |

| M4 | AOCI Attributable to Parent [Member] | | Duration | AccumulatedOtherComprehensiveIncomeMember |

| M5 | Noncontrolling Interest [Member] | | Duration | NoncontrollingInterestMember |

| | | | |

| A2 | Revision of Prior Period [Axis] | | Duration | RestatementAxis |

| Revision of Prior Period [Domain] | | Duration | RestatementDomain |

| M6 | Previously Reported [Member] | | Duration | ScenarioPreviouslyReportedMember |

| M7 | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | Duration | RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember |

| | | | |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | Credit | Instant | StockholdersEquityIncludingPortionAttributableToNoncontrollingInterest |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | Duration | AccountingStandardsUpdateExtensibleList |

Figure 1.2

The XBRL report views created using the modeling structure are provided here:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Standard Label | Preferred Label | | | | | | | | | | | | | | | |

| Date Context | | 20X0-12-31 |

| Equity Components [Axis] | | Common Stock [Member] | Additional Paid-in Capital [Member] | Retained Earnings [Member] | AOCI Attributable to Parent [Member] | Noncontrolling Interest [Member] | | | Report-wide Value |

| A1 | | M1 | M2 | M3 | M4 | M5 | | |

| Revision of Prior Period [Axis] | | Previously Reported [Member] | | Previously Reported [Member] | | Previously Reported [Member] | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | Previously Reported [Member] | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | Previously Reported [Member] | | Previously Reported [Member] | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] |

| A2 | | M6 | | M6 | | M6 | M7 | | M6 | M7 | | M6 | | M6 | M7 |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | Consolidated statement of stockholders' equity, ending balance | 1000000 | 1000000 | 840000000 | 840000000 | 1703715000 | -15000000 | 1688715000 | -106400000 | -25000000 | -131400000 | -10000000 | -10000000 | 2428315000 | -40000000 | 2388315000 |

Figure 1.3a

| | | | | | | | | | | | | | |

| | | | |

| Standard Label | Preferred Label | | |

| Date Context | | 20X0-01-01 to 20X0-12-31 | |

| XL2 | Accounting Standards Update [Extensible Enumeration] | Adoption of ASU 20XX-X1 | http://fasb.org/us-gaap/20X0#AccountingStandardsUpdate20XXX1Member | |

Figure 1.3b

Notes:

•An extensible enumeration element is used to convey the amendment from one ASU. “Accounting Standards Update [Extensible Enumeration]” (XL2) is used to tag the fact value indicating which amendment from an ASU is affecting retained earnings and AOCI in the Statement of Shareholders’ Equity. If a filer reports values from amendments from more than one ASU within the filing in the same reporting date context, then the “Accounting Standards Update [Axis]” (A4) is intended to be used.

•The “Revision of Prior Period [Axis]” (A2) and its related domain and member (“Revision of Prior Period, Reclassification, Adjustment [Member]” (M9)) are intended to be used if a filer discloses amounts for other reclassifications affecting comparability. In addition, there are other members under the “Revision of Prior Period [Axis]” (A2) for each type of adjustment including error corrections (“Revision of Prior Period, Error Correction, Adjustment [Member]” (M8)) and changes in accounting principle (“Revision of Prior Period, Change in Accounting Principle, Adjustment [Member]”).

•ASU 20XX-X1 is assumed to be adopted with a retrospective transition method and applied to the earliest period presented in this example.

Example 2—Retrospective Effect on Financial Statement Line Items for Each Individual Prior Period Balance Presented

This example illustrates the modeling for disclosure of transition adjustments to other line items in the Statement of Financial Position in the earliest period presented.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (in thousands) | | A2:M6 | | A2:M7 | | | |

| | Amount previously reported 12/31/20X0 | | Effect from ASU 20XX-X1 12/31/20X0 | | Adjusted amount 12/31/20X0 | |

| | | | [1] | | | |

| Liability for future policy benefit, before reinsurance | L3 | $ | 740,100 | | | $ | 40,000 | | | $ | 780,100 | | |

| Retained earnings (accumulated deficit) | L4 | $ | 1,703,715 | | | $ | (15,000) | | | $ | 1,688,715 | | |

| Accumulated other comprehensive income (loss) | L5 | $ | (106,400) | | | $ | (25,000) | | | $ | (131,400) | | |

| |

| | | | | | | |

_____________________________

Legend†:

†This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] XL2

Figure 2.1

The legend for the elements used to tag these facts follows:

| | | | | | | | | | | | | | |

| Standard Label | Balance Type | Period Type | Element Name |

| A2 | Revision of Prior Period [Axis] | | Duration | RestatementAxis |

| Revision of Prior Period [Domain] | | Duration | RestatementDomain |

| M6 | Previously Reported [Member] | | Duration | ScenarioPreviouslyReportedMember |

| M7 | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | Duration | RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember |

| | | | |

| L3 | Liability for Future Policy Benefit, before Reinsurance | Credit | Instant | LiabilityForFuturePolicyBenefits |

| L4 | Retained Earnings (Accumulated Deficit) | Credit | Instant | RetainedEarningsAccumulatedDeficit |

| L5 | Accumulated Other Comprehensive Income (Loss), Net of Tax | Credit | Instant | AccumulatedOtherComprehensiveIncomeLossNetOfTax |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | Duration | AccountingStandardsUpdateExtensibleList |

Figure 2.2

The XBRL report views created using the modeling structure are provided here:

| | | | | | | | | | | | | | | | | |

| | | | | |

| Standard Label | Preferred Label | | | |

| Date Context | | 20X0-12-31 |

| Revision of Prior Period [Axis] | | Previously Reported [Member] | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | Report-wide Value |

| A2 | | M6 | M7 |

| L3 | Liability for Future Policy Benefit, before Reinsurance | Liability for future policy benefit, before reinsurance | 740100000 | 40000000 | 780100000 |

| L4 | Retained Earnings (Accumulated Deficit) | Retained earnings (accumulated deficit) | 1703715000 | -15000000 | 1688715000 |

| L5 | Accumulated Other Comprehensive Income (Loss), Net of Tax | Accumulated other comprehensive income (loss) | -106400000 | -25000000 | -131400000 |

Figure 2.3a

| | | | | | | | | | | |

| Standard Label | Preferred Label | |

| Date Context | | 20X0-01-01 to 20X0-12-31 |

| XL2 | Accounting Standards Update [Extensible Enumeration] | Effect from ASU 20XX-X1 | http://fasb.org/us-gaap/20X0#AccountingStandardsUpdate20XXX1Member |

Figure 2.3b

Notes:

•An extensible enumeration element is used to convey the amendment from one ASU. “Accounting Standards Update [Extensible Enumeration]” (XL2) is used to tag the fact value indicating which amendment from an ASU is affecting balances in the Statement of Financial Position. If a filer reports values from amendments from more than one ASU within the filing in the same reporting date context, then the “Accounting Standards Update [Axis]” (A4) is intended to be used.

•The “Revision of Prior Period [Axis]” (A2) and its related domain and member (“Revision of Prior Period, Reclassification, Adjustment [Member]” (M9)) are intended to be used if a filer discloses amounts for other reclassifications affecting comparability. In addition, there are other members under the “Revision of Prior Period [Axis]” (A2) for each type of adjustment including error corrections (“Revision of Prior Period, Error Correction, Adjustment [Member]” (M8)) and changes in accounting principle (“Revision of Prior Period, Change in Accounting Principle, Adjustment [Member]”).

•ASU 20XX-X1 is assumed to be adopted with a retrospective transition method and applied to the earliest period presented in this example.

Example 3—Cumulative Effect on Opening Balance in Period of Adoption

This example provides an excerpt of the Statement of Stockholders' Equity to illustrate the modeling for the values for the cumulative effect in the period of adoption transition adjustments to retained earnings and AOCI for application in the current period presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Consolidated Statements of Shareholders’ Equity | |

| (in thousands) | | | | | | | | | | | | | | |

| | | A1:M1 | | A1:M2 | | A1:M3 | | A1:M4 | | A1:M5 | | | |

| | | Common stock | | Additional paid-in capital | | Retained Earnings | | Accumulated other comprehensive (loss) income | | Noncontrolling interest | | Total | |

| Balance at December 31, 20X2 | | L1 | $ | 1,000 | | | $ | 875,000 | | | $ | 1,819,555 | | | $ | (100,850) | | | $ | 6,405 | | | $ | 2,601,110 | | |

| Cumulative effect of ASU 20XX-X2 | [1] | L1, A3:M11 | | | | | 15,000 | | | (15,000) | | | | | — | | |

| Adjusted Balance at December 31, 20X2 | | L1, A3:M12 | $ | 1,000 | | | $ | 875,000 | | | $ | 1,834,555 | | | $ | (115,850) | | | $ | 6,405 | | | $ | 2,601,110 | | |

| |

| | | | | | | | | | | | | | |

_____________________________

Legend†:

†This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] XL2

Figure 3.1

The legend for the elements used to tag these facts follows:

| | | | | | | | | | | | | | |

| Standard Label | Balance Type | Period Type | Element Name |

| A1 | Equity Components [Axis] | | Duration | StatementEquityComponentsAxis |

| Equity Component [Domain] | | Duration | EquityComponentDomain |

| M1 | Common Stock [Member] | | Duration | CommonStockMember |

| M2 | Additional Paid-in Capital [Member] | | Duration | AdditionalPaidInCapitalMember |

| M3 | Retained Earnings [Member] | | Duration | RetainedEarningsMember |

| M4 | AOCI Attributable to Parent [Member] | | Duration | AccumulatedOtherComprehensiveIncomeMember |

| M5 | Noncontrolling Interest [Member] | | Duration | NoncontrollingInterestMember |

| | | | |

| A3 | Cumulative Effect, Period of Adoption [Axis] | | Duration | CumulativeEffectPeriodOfAdoptionAxis |

| Cumulative Effect, Period of Adoption [Domain] | | Duration | CumulativeEffectPeriodOfAdoptionDomain |

| M11 | Cumulative Effect, Period of Adoption, Adjustment [Member] | | Duration | CumulativeEffectPeriodOfAdoptionAdjustmentMember |

| M12 | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Duration | CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember |

| | | | |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | Credit | Instant | StockholdersEquityIncludingPortionAttributableToNoncontrollingInterest |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | Duration | AccountingStandardsUpdateExtensibleList |

Figure 3.2

The XBRL report views created using the modeling structure are provided here:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Standard Label | Preferred Label | | | | | | | | | | | | | | | | |

| Date Context | | 20X2-12-31 | |

| Equity Components [Axis] | | Common Stock [Member] | Additional Paid-in Capital [Member] | Retained Earnings [Member] | AOCI Attributable to Parent [Member] | Noncontrolling Interest [Member] | | | Report-wide Value | |

| A1 | | M1 | M2 | M3 | M4 | M5 | | | |

| Cumulative Effect, Period of Adoption [Axis] | | | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Cumulative Effect, Period of Adoption, Adjustment [Member] | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Cumulative Effect, Period of Adoption, Adjustment [Member] | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | Cumulative Effect, Period of Adoption, Adjustment [Member] | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | |

| A3 | | | M12 | | M12 | | M11 | M12 | | M11 | M12 | | M12 | M11 | M12 | |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | Consolidated statement of stockholders' equity, ending balance | 1000000 | 1000000 | 875000000 | 875000000 | 1819555000 | 15000000 | 1834555000 | -100850000 | -15000000 | -115850000 | 6405000 | 6405000 | 0 | 2601110000 | 2601110000 | |

Figure 3.3a

| | | | | | | | | | | | | | |

| | | | |

| Standard Label | Preferred Label | | |

| Date Context | | 20X2-01-01 to 20X2-12-31 | |

| XL2 | Accounting Standards Update [Extensible Enumeration] | Cumulative effect of ASU 20XX-X2 | http://fasb.org/us-gaap/20X2#AccountingStandardsUpdate20XXX2Member | |

Figure 3.3b

Notes:

•This example and Example 1 both use a prior period as the date context. For the cumulative effect in the period of adoption, the context is the period prior to the period of adoption. For the retrospective application, the context is the earliest period presented. The difference between the modeling of the cumulative effect in period of adoption transition adjustments and the retrospective transition adjustments is which amount is tagged as the report-wide value. In this example, the report-wide value is the opening balance for stockholders' equity which does not include the effect of the amendment from the ASU, whereas in Example 1 the report-wide value is the balance for stockholders' equity after the effect of the amendment from the ASU.

•An extensible enumeration element is used to convey the amendment from one ASU. “Accounting Standards Update [Extensible Enumeration]” (XL2) is used to tag the fact value indicating which amendment from an ASU is affecting the opening balance of retained earnings in the period of adoption in the Statement of Shareholders’ Equity. If a filer reports values from amendments from more than one ASU within the filing in the same reporting date context, then the “Accounting Standards Update [Axis]” (A4) is intended to be used.

•ASU 20XX-X2 is assumed to be adopted with a cumulative effect in the period of adoption transition method and applied to the opening balance in the current reporting period in this example.

Example 4—Disclosure of Reclassifications from an ASU

This example illustrates the modeling for reclassification adjustments to specific line items affected by amendments from an ASU. In a note on significant accounting policies, ABC Company discloses the amount of reclassifications from one financial statement line item to another as a result of adopting Accounting Standards Update 20XX-X3.

Effective January 1, 20X3[1], ABC Company (ABC Co.) adopted ASU 20XX-X3[2][3] using the full retrospective transition approach[4]. As a result of the adoption, ABC Co. reclassified $0.5 million and $0.4 million from operating expenses[5] to net periodic benefit (income) expense, excluding service cost,[6] for the years ended December 31, 20X2 and 20X1, respectively. $0.5 million $0.4 million

_____________________________

Legend†:

†This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] L22 2025-01-01

[2] XL2

[3] XL39

[4] XL24

[5] L6, A2:M7

[6] L7, A2:M7 400000 500000

Figure 4.1

The legend for the elements used to tag these facts follows:

| | | | | | | | | | | | | | |

| Standard Label | Balance Type | Period Type | Element Name |

| A2 | Revision of Prior Period [Axis] | | Duration | RestatementAxis |

| Revision of Prior Period [Domain] | | Duration | RestatementDomain |

| M7 | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | Duration | RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember |

| | | | |

| L6 | Operating Expenses | Debit | Duration | OperatingExpenses |

| L7 | Net Periodic Defined Benefits Expense (Reversal of Expense), Excluding Service Cost Component | Debit | Duration | NetPeriodicDefinedBenefitsExpenseReversalOfExpenseExcludingServiceCostComponent |

| L22 | Change in Accounting Principle, Accounting Standards Update, Adoption Date | | Instant | ChangeInAccountingPrincipleAccountingStandardsUpdateAdoptionDate |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | Duration | AccountingStandardsUpdateExtensibleList |

| XL24 | Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration] | | Duration | ChangeInAccountingPrincipleAccountingStandardsUpdateTransitionOptionElectedExtensibleList |

| XL39 | Change in Accounting Principle, Accounting Standards Update, Adopted [true false] | | Instant | ChangeInAccountingPrincipleAccountingStandardsUpdateAdopted |

Figure 4.2

The XBRL report view created using the modeling structure is provided here:

| | | | | | | | |

| | |

| Standard Label | |

| Date Context | 20X3-12-31 |

| L22 | Change in Accounting Principle, Accounting Standards Update, Adoption Date | 20X3-01-01 |

| XL39 | Change in Accounting Principle, Accounting Standards Update, Adopted [true false] | true |

Figure 4.3a

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Standard Label | Preferred Label | | | | |

| Date Context | | 20X1-01-01 to 20X1-12-31 | 20X2-01-01 to 20X2-12-31 |

| Revision of Prior Period [Axis] | | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | |

| A2 | | M7 | | M7 | |

| L6 | Operating Expenses | 0perating expense | -400000 | | -500000 | |

| L7 | Net Periodic Defined Benefits Expense (Reversal of Expense), Excluding Service Cost Component | net periodic benefit (income) expense, excluding service cost | 400000 | | 500000 | |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | | http://fasb.org/us-gaap/20X3#AccountingStandardsUpdate20XXX3Member | | http://fasb.org/us-gaap/20X3#AccountingStandardsUpdate20XXX3Member |

Figure 4.3b

| | | | | | | | | | | |

| | | |

| Standard Label | Preferred Label | |

| Date Context | | 20X3-01-01 to 20X3-12-31 |

| XL24 | Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration] | full retrospective transition approach | http://fasb.org/us-gaap/20X3#AccountingStandardsUpdate20XXX3RetrospectiveMember |

Figure 4.3c

Notes:

•In this example, “Revision of Prior Period, Accounting Standards Update, Adjustment [Member]” (M7) is used instead of “Revision of Prior Period, Reclassification, Adjustment [Member]” (M9) because the adjustments are for reclassifications from amendments to the accounting standards.

•An extensible enumeration element is used to convey the amendment from one ASU. “Accounting Standards Update [Extensible Enumeration]” (XL2) is used to tag the fact value indicating which amendment from an ASU is affecting operating expenses and the net periodic benefit (income) expense, excluding service cost in the Statement of Income. If a filer reports values from amendments from more than one ASU within the filing in the same reporting date context, then the “Accounting Standards Update [Axis]” (A4) is intended to be used.

•The “Revision of Prior Period [Axis]” (A2) and its related domain and member (“Revision of Prior Period, Reclassification, Adjustment [Member]” (M9)) are intended to be used if a filer discloses amounts for other reclassifications affecting comparability that are not related to amendments to the accounting standards. In addition, there are other members under the “Revision of Prior Period [Axis]” (A2) for each type of adjustment including error corrections (“Revision of Prior Period, Error Correction, Adjustment [Member]” (M8)) and changes in accounting principle (“Revision of Prior Period, Change in Accounting Principle, Adjustment [Member]”).

•ASU 20XX-X3 is assumed to be adopted with a retrospective transition method and applied to the earliest period presented in this example. “Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration]” (XL24) is used to tag the fact value indicating which transition option is elected only when there is a choice in transition option.

Example 5—Multiple Adjustments on Statement of Stockholders' Equity for Each Individual Prior Period Balance Presented

This example provides a Statement of Stockholders' Equity to illustrate the modeling for the values for transition adjustments for application to the earliest period presented related to retrospective transition method for one amendment from an ASU and for application in the current period presented for the cumulative effect in the period of adoption for another amendment from an ASU. It also provides information about adjustments for an error correction.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Consolidated Statements of Shareholders’ Equity | |

| (in thousands) | | | | | | | | | | | | | | |

| | | A1:M1 | | A1:M2 | | A1:M3 | | A1:M4 | | A1:M5 | | | |

| | | Common stock | | Additional paid-in capital | | Retained Earnings | | Accumulated other comprehensive (loss) income | | Noncontrolling interest | | Total | |

| Balance at December 31, 20X0 | | L1, A2:M6 | $ | 1,000 | | | $ | 840,000 | | | $ | 1,649,000 | | | $ | (99,000) | | | $ | (9,500) | | | $ | 2,381,500 | | |

| Adoption of ASU 20XX-X1 | [1] | L1, A2:M7 | | | | | (15,000) | | | (25,000) | | | | | (40,000) | | |

| Error correction - incorrect calculation of depreciation | [2] | L1, A2:M8 | | | | | (7,500) | | | | | | | (7,500) | | |

| Adjusted Balance at December 31, 20X0 | | L1 | $ | 1,000 | | | $ | 840,000 | | | $ | 1,626,500 | | | $ | (124,000) | | | $ | (9,500) | | | $ | 2,334,000 | | |

| Net income | | L8 | | | | | 33,000 | | | | | 4,750 | | | 37,750 | | |

| Other comprehensive income, net of tax | | L9 | | | | | | | 2,950 | | | 3,200 | | | 6,150 | | |

| Compensation under stock-based plans, net | | L10 | | | 20,000 | | | | | | | | | 20,000 | | |

| Restated balance at December 31, 20X1 | | L1 | $ | 1,000 | | | $ | 860,000 | | | $ | 1,659,500 | | | $ | (121,050) | | | $ | (1,550) | | | $ | 2,397,900 | | |

| Net income | | L8 | | | | | 55,000 | | | | | 5,100 | | | 60,100 | | |

| Other comprehensive income, net of tax | | L9 | | | | | | | 3,275 | | | 2,800 | | | 6,075 | | |

| Compensation under stock-based plans, net | | L10 | | | 15,000 | | | | | | | | | 15,000 | | |

| Restated balance at December 31, 20X2 | | L1 | $ | 1,000 | | | $ | 875,000 | | | $ | 1,714,500 | | | $ | (117,775) | | | $ | 6,350 | | | $ | 2,479,075 | | |

| Cumulative effect of ASU 20XX-X4 | | L1, A3:M11, A4:M13 | | | | | 9,150 | | | | | | | 9,150 | | |

| Cumulative effect of ASU 20XX-X5 | | L1, A3:M11, A4:M14 | | | | | (3,000) | | | $ | 3,000 | | | | | — | | |

| Adjusted Balance at December 31, 20X2 | | L1, A3:M12 | $ | 1,000 | | | $ | 875,000 | | | $ | 1,720,650 | | | $ | (114,775) | | | $ | 6,350 | | | $ | 2,488,225 | | |

| Net income | | L8 | | | | | 61,000 | | | | | 6,200 | | | 67,200 | | |

| Other comprehensive income, net of tax | | L9 | | | | | | | 4,330 | | | 1,960 | | | 6,290 | | |

| Compensation under stock-based plans, net | | L10 | | | 14,500 | | | | | | | | | 14,500 | | |

| Balance at December 31, 20X3 | | L1 | $ | 1,000 | | | $ | 889,500 | | | $ | 1,781,650 | | | $ | (110,445) | | | $ | 14,510 | | | $ | 2,576,215 | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

_____________________________

Legend: This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] XL2 [2] XL20

Figure 5.1

The legend for the elements used to tag these facts follows:

| | | | | | | | | | | | | | |

| Standard Label | Balance Type | Period Type | Element Name |

| A1 | Equity Components [Axis] | | Duration | StatementEquityComponentsAxis |

| Equity Component [Domain] | | Duration | EquityComponentDomain |

| M1 | Common Stock [Member] | | Duration | CommonStockMember |

| M2 | Additional Paid-in Capital [Member] | | Duration | AdditionalPaidInCapitalMember |

| M3 | Retained Earnings [Member] | | Duration | RetainedEarningsMember |

| M4 | AOCI Attributable to Parent [Member] | | Duration | AccumulatedOtherComprehensiveIncomeMember |

| M5 | Noncontrolling Interest [Member] | | Duration | NoncontrollingInterestMember |

| | | | |

| A2 | Revision of Prior Period [Axis] | | Duration | RestatementAxis |

| Revision of Prior Period [Domain] | | Duration | RestatementDomain |

| M6 | Previously Reported [Member] | | Duration | ScenarioPreviouslyReportedMember |

| M7 | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | Duration | RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember |

| M8 | Revision of Prior Period, Error Correction, Adjustment [Member] | | Duration | RevisionOfPriorPeriodErrorCorrectionAdjustmentMember |

| | | | |

| A3 | Cumulative Effect, Period of Adoption [Axis] | | Duration | CumulativeEffectPeriodOfAdoptionAxis |

| Cumulative Effect, Period of Adoption [Domain] | | Duration | CumulativeEffectPeriodOfAdoptionDomain |

| M11 | Cumulative Effect, Period of Adoption, Adjustment [Member] | | Duration | CumulativeEffectPeriodOfAdoptionAdjustmentMember |

| M12 | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Duration | CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember |

| | | | |

| A4 | Accounting Standards Update [Axis] | | Duration | AdjustmentsForNewAccountingPronouncementsAxis |

| Accounting Standards Update [Domain] | | Duration | TypeOfAdoptionMember |

| M13 | Accounting Standards Update 20XX-X4 [Member] | | Duration | AccountingStandardsUpdate20XXX4Member |

| M14 | Accounting Standards Update 20XX-X5 [Member] | | Duration | AccountingStandardsUpdate20XXX5Member |

| | | | |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | Credit | Instant | StockholdersEquityIncludingPortionAttributableToNoncontrollingInterest |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | Duration | AccountingStandardsUpdateExtensibleList |

| L8 | Net Income (Loss), Including Portion Attributable to Noncontrolling Interest | Credit | Duration | ProfitLoss |

| L9 | Other Comprehensive Income (Loss), Net of Tax | Credit | Duration | OtherComprehensiveIncomeLossNetOfTax |

| L10 | APIC, Share-Based Payment Arrangement, Increase for Cost Recognition | Credit | Duration | AdjustmentsToAdditionalPaidInCapitalSharebasedCompensationRequisiteServicePeriodRecognitionValue |

| XL20 | Error Correction, Type [Extensible Enumeration] | | Duration | ErrorCorrectionTypeExtensibleList |

Figure 5.2

The XBRL report views created using the modeling structure are provided here:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Standard Label | Preferred Label | | | | | | | | | | | | | | | | | |

| Date Context | | 20X0-12-31 |

| Equity Components [Axis] | | Common Stock [Member] | Additional Paid-in Capital [Member] | Retained Earnings [Member] | AOCI Attributable to Parent [Member] | Noncontrolling Interest [Member] | | | | Report-wide Value |

| A1 | | M1 | M2 | M3 | M4 | M5 | | | |

| Revision of Prior Period [Axis] | | Previously Reported [Member] | | Previously Reported [Member] | | Previously Reported [Member] | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | Revision of Prior Period, Error Correction, Adjustment [Member] | | Previously Reported [Member] | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | | Previously Reported [Member] | | Previously Reported [Member] | Revision of Prior Period, Accounting Standards Update, Adjustment [Member] | Revision of Prior Period, Error Correction, Adjustment [Member] |

| A2 | | M6 | | M6 | | M6 | M7 | M8 | | M6 | M7 | | M6 | | M6 | M7 | M8 |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | Consolidated statement of stockholders' equity, ending balance | 1000000 | 1000000 | 840000000 | 840000000 | 1649000000 | -15000000 | -7500000 | 1626500000 | -99000000 | -25000000 | -124000000 | -9500000 | -9500000 | 2381500000 | -40000000 | -7500000 | 2334000000 |

Figure 5.3a

| | | | | | | | | | | |

| | | |

| Standard Label | Preferred Label | |

| Date Context | | 20X0-01-01 to 20X0-12-31 |

| XL2 | Accounting Standards Update [Extensible Enumeration] | Adoption of ASU 20XX-X1 | http://fasb.org/us-gaap/20X3#AccountingStandardsUpdate20XXX1Member |

| XL20 | Error Correction, Type [Extensible Enumeration] | Error correction - incorrect calculation of depreciation | http://www.abc.com/20X31231#IncorrectCalculationOfDepreciationMember |

Figure 5.3b

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Standard Label | Preferred Label | | | | | | | | | | | | | | | | | | |

| Date Context | | 12/31/20X2 | |

| Equity Components [Axis] | | Common Stock [Member] | Additional Paid-in Capital [Member] | Retained Earnings [Member] | AOCI Attributable to Parent [Member] | Noncontrolling Interest [Member] | | | | Report-wide Value | |

| A1 | | M1 | M2 | M3 | M4 | M5 | | | | |

| Cumulative Effect, Period of Adoption [Axis] | | | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Cumulative Effect, Period of Adoption, Adjustment [Member] | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Cumulative Effect, Period of Adoption, Adjustment [Member] | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | Cumulative Effect, Period of Adoption, Adjustment [Member] | Cumulative Effect, Period of Adoption, Adjusted Balance [Member] | |

| A3 | | | M12 | | M12 | | M11 | M12 | | M11 | M12 | | M12 | M11 | M12 | |

| Accounting Standards Update [Axis] | | | | | | | Accounting Standards Update 20XX-X4 [Member] | Accounting Standards Update 20XX-X5 [Member] | | | Accounting Standards Update 20XX-X5 [Member] | | | | Accounting Standards Update 20XX-X4 [Member] | Accounting Standards Update 20XX-X5 [Member] | | | |

| A4 | | | | | | | M13 | M14 | | | M14 | | | | M13 | M14 | | | |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | Consolidated statement of stockholders' equity, ending balance | 1000000 | 1000000 | 875000000 | 875000000 | 1714500000 | 9150000 | -3000000 | 1720650000 | -117775000 | 3000000 | -114775000 | 6350000 | 6350000 | 9150000 | 0 | 2488225000 | 2479075000 | |

Figure 5.3c

Notes:

•Figures 5.3a through 5.3c provide information for the reporting periods (20X0 and 20X2) with adjustments for transition to amendments from ASUs and error corrections. The other reporting periods (20X1 and 20X3) would be similarly structured without the use of the “Revision of Prior Period [Axis]” (A2) and its members.

•An extensible enumeration element is used to convey the amendment from one ASU. “Accounting Standards Update [Extensible Enumeration]” (XL2) is used to tag the fact value indicating which amendment from an ASU is affecting retained earnings and AOCI in the Statement of Shareholders’ Equity. If a filer reports values from amendments from more than one ASU within the filing in the same reporting date context, then the “Accounting Standards Update [Axis]” (A4) is intended to be used.

•An extensible enumeration element is used to convey the type of error correction. “Error Correction, Type [Extensible Enumeration]” (XL20) is used to tag the fact value indicating the type of error correction affecting retained earnings in the Statement of Shareholders’ Equity. If a filer reports values from more than one error correction within the filing in the same reporting date context, then the “Error Correction, Type [Axis]” is intended to be used.

•ASU 20XX-X1 is assumed to be adopted with a retrospective transition method and applied to the earliest period presented in this example. ASU 20XX-X4 and 20XX-X5 are assumed to be adopted with a cumulative effect in the period of adoption transition method and applied to the opening balance in the current reporting period in this example.

Example 6—Effect on Financial Statement Line Items from Multiple Adjustments to Previously Reported Amounts

This example provides disclosure information about the effects of adjustments for reclassifications from discontinued operations and error corrections, shown separately in excerpts of the Statement of Income and the Statement of Financial Position. A reconciliation of the amounts previously reported to the adjusted amounts are shown in the tables below for the effected financial statement line items.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Entity ABC | |

| Statements of Income Detail | |

| For the Year Ended December 31, | |

| | 20X2 | | 20X1 | |

| | A2:M6 | A2:M9 | A2:M8 | | | A2:M6 | A2:M9 | A2:M8 | | |

| (in thousands) | | Amount previously reported | Reclassification of discontinued operations | Error corrections - misapplication of GAAP | Adjusted amount | | Amount previously reported | Reclassification of discontinued operations | Error corrections - misapplication of GAAP | Adjusted amount | |

| | | [2] | [1] | | | | [2] | [1] | | |

| Revenues | L11 | $ | 145,450 | | (25,000) | | (2,000) | | $ | 118,450 | | | $ | 125,325 | | (20,000) | | (4,000) | | $ | 101,325 | | |

| Costs of revenues | L12 | $ | 18,190 | | (6,250) | | 560 | | $ | 12,500 | | | $ | 20,000 | | (2,695) | | 195 | | $ | 17,500 | | |

| Selling, general and administrative expenses | L13 | $ | 250 | | (200) | | 50 | | $ | 100 | | | $ | 200 | | (100) | | 350 | | $ | 450 | | |

| Other nonoperating income (expense), net | L14 | $ | (1,100) | | (400) | | — | | $ | (1,500) | | | $ | (750) | | (600) | | — | | $ | (1,350) | | |

| Income (loss) from discontinued operations, net | L15 | $ | — | | 18,950 | | — | | $ | 18,950 | | | $ | — | | 17,805 | | — | | $ | 17,805 | | |

| |

| | | | | | | | | | | |

_____________________________

Legend†:

†This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] XL20 [2] XL21

Figure 6.1a

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Entity ABC | |

| Statements of Financial Position Detail | |

| As of December 31, | |

| | 20X2 | | 20X1 | |

| | A2:M6 | A2:M9 | A2:M8 | | | A2:M6 | A2:M9 | A2:M8 | | |

| (in thousands) | | Amount previously reported | Reclassification of discontinued operations | Error corrections - misapplication of GAAP | Adjusted amount | | Amount previously reported | Reclassification of discontinued operations | Error corrections - misapplication of GAAP | Adjusted amount | |

| | | [2] | [1] | | | | [2] | [1] | | |

| Property, plant and equipment, net | L16 | $ | 1,575,000 | | (85,000) | | — | | $ | 1,490,000 | | | $ | 1,465,500 | | (67,000) | | — | | $ | 1,398,500 | | |

| Total assets | L17 | $ | 5,600,000 | | — | | 35,000 | | $ | 5,635,000 | | | $ | 4,950,000 | | — | | 44,000 | | $ | 4,994,000 | | |

| Total liabilities | L18 | $ | 3,123,785 | | — | | (65,000) | | $ | 3,058,785 | | | $ | 2,980,000 | | — | | (48,000) | | $ | 2,932,000 | | |

| Assets held for sale from discontinued operations | L19 | $ | — | | 85,000 | | — | | $ | 85,000 | | | $ | — | | 67,000 | | — | | $ | 67,000 | | |

| |

| | | | | | | | | | | |

_____________________________

Legend†:

†This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] XL20 [2] XL21

Figure 6.1b

The legend for the elements used to tag these facts follows:

| | | | | | | | | | | | | | |

| Standard Label | Balance Type | Period Type | Element Name |

| A2 | Revision of Prior Period [Axis] | | Duration | RestatementAxis |

| Revision of Prior Period [Domain] | | Duration | RestatementDomain |

| M6 | Previously Reported [Member] | | Duration | ScenarioPreviouslyReportedMember |

| M8 | Revision of Prior Period, Error Correction, Adjustment [Member] | | Duration | RevisionOfPriorPeriodErrorCorrectionAdjustmentMember |

| M9 | Revision of Prior Period, Reclassification, Adjustment [Member] | | Duration | RevisionOfPriorPeriodReclassificationAdjustmentMember |

| | | | |

| L11 | Revenues | Credit | Duration | Revenues |

| L12 | Cost of Revenue | Debit | Duration | CostOfRevenue |

| L13 | Selling, General and Administrative Expense | Debit | Duration | SellingGeneralAndAdministrativeExpense |

| L14 | Other Nonoperating Income (Expense) | Credit | Duration | OtherNonoperatingIncomeExpense |

| L15 | Income (Loss) from Discontinued Operations, Net of Tax, Including Portion Attributable to Noncontrolling Interest | Credit | Duration | IncomeLossFromDiscontinuedOperationsNetOfTax |

| L16 | Property, Plant and Equipment, Net | Debit | Instant | PropertyPlantAndEquipmentNet |

| L17 | Assets | Debit | Instant | Assets |

| L18 | Liabilities | Credit | Instant | Liabilities |

| L19 | Disposal Group, Including Discontinued Operation, Assets, Current | Debit | Instant | AssetsOfDisposalGroupIncludingDiscontinuedOperationCurrent |

| XL20 | Error Correction, Type [Extensible Enumeration] | | Duration | ErrorCorrectionTypeExtensibleList |

| XL21 | Reclassification, Type [Extensible Enumeration] | | Duration | ReclassificationTypeExtensibleList |

Figure 6.2

The XBRL report views created using the modeling structure are provided here:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Standard Label | Preferred Label | | | | |

| Date Context | | 20X2-01-01 to 20X2-12-31 |

| Revision of Prior Period [Axis] | | Amount previously reported | Reclassification | Error corrections | Report-wide Value |

| A2 | | M6 | M9 | M8 |

| L11 | Revenues | Revenues | 145450000 | -25000000 | -2000000 | 118450000 |

| L12 | Cost of Revenue | Costs of revenues | 18190000 | -6250000 | 560000 | 12500000 |

| L13 | Selling, General and Administrative Expense | Selling, general and administrative expenses | 250000 | -200000 | 50000 | 100000 |

| L14 | Other Nonoperating Income (Expense) | Other nonoperating income (expense), net | -1100000 | -400000 | 0 | -1500000 |

| L15 | Income (Loss) from Discontinued Operations, Net of Tax, Including Portion Attributable to Noncontrolling Interest | Income (loss) from discontinued operations, net | 0 | 18950000 | 0 | 18950000 |

| XL21 | Reclassification, Type [Extensible Enumeration] | Reclassification of discontinued operations | | | | http://www.abc.com/20X21231#DiscontinuedOperationsMember |

| XL20 | Error Correction, Type [Extensible Enumeration] | Error corrections - misapplication of GAAP | | | | http://www.abc.com/20X21231#MisapplicationOfGAAPMember |

Figure 6.3a

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Standard Label | Preferred Label | | | | |

| Date Context | | 20X2-12-31 |

| Revision of Prior Period [Axis] | | Amount previously reported | Reclassification | Error corrections | Report-wide Value |

| A2 | | M6 | M9 | M8 |

| L16 | Property, Plant and Equipment, Net | Property, plant and equipment, net | 1575000000 | -85000000 | 0 | 1490000000 |

| L17 | Assets | Total assets | 5600000000 | 0 | 35000000 | 5635000000 |

| L18 | Liabilities | Total liabilities | 3123785000 | 0 | -65000000 | 3058785000 |

| L19 | Disposal Group, Including Discontinued Operation, Assets, Current | Assets held for sale from discontinued operations | 0 | 85000000 | 0 | 85000000 |

Figure 6.3b

Notes:

•Figures 6.3a and 6.3b provide information for one reporting period (20X2). The other reporting period (20X1) would be similarly structured.

•An extensible enumeration element is used to convey the type of reclassification. “Reclassification, Type [Extensible Enumeration]” (XL21) is used to tag the fact value indicating which reclassification is affecting the comparability of the financial statements. If a filer reports values from more than one reclassification within the filing in the same reporting date context, then the “Reclassification, Type [Axis]” is intended to be used.

•An extensible enumeration element is used to convey the type of error correction. “Error Correction, Type [Extensible Enumeration]” (XL20) is used to tag the fact value indicating which error correction is affecting the financial statements. If a filer reports values from more than one error correction within the filing in the same reporting date context, then the “Error Correction, Type [Axis]” is intended to be used.

Example 7—Disclosure of Textual Transition Information

This example illustrates the modeling for disclosures reporting textual transition information about amendments from an ASU. In a note on significant accounting policies, ABC Company discloses information about the nature and timing of adopting Accounting Standards Update 20XX-X6.

Effective January 1, 20X3,[1] ABC Company (ABC Co.) early adopted[2] ASU 20XX-X6[3], using the full retrospective transition approach[4]. Overall, ASU 20XX-X6 had a material impact on ABC Co.'s consolidated financial statements. See below for additional information including the impacts of ASU 20XX-X6 on the previously reported financial statements.

_____________________________

Legend†:

†This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] L22 2025-01-01

[2] L23

[3] XL2

[4] XL24

Figure 7.1

The legend for the elements used to tag these facts follows:

| | | | | | | | | | | | | | |

| Standard Label | Balance Type | Period Type | Element Name |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | Duration | AccountingStandardsUpdateExtensibleList |

| L22 | Change in Accounting Principle, Accounting Standards Update, Adoption Date | | Instant | ChangeInAccountingPrincipleAccountingStandardsUpdateAdoptionDate |

| L23 | Change in Accounting Principle, Accounting Standards Update, Early Adoption [true false] | | Instant | ChangeInAccountingPrincipleAccountingStandardsUpdateEarlyAdoption |

| XL24 | Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration] | | Duration | ChangeInAccountingPrincipleAccountingStandardsUpdateTransitionOptionElectedExtensibleList |

Figure 7.2

The XBRL report views created using the modeling structure are provided here:

| | | | | | | | | | | |

| | | |

| Standard Label | Preferred Label | |

| Date Context | | 20X3-12-31 |

| L22 | Change in Accounting Principle, Accounting Standards Update, Adoption Date | | 20X3-01-01 |

| L23 | Change in Accounting Principle, Accounting Standards Update, Early Adoption [true false] | early adopted ASU 20XX-X6 | true |

Figure 7.3a

| | | | | | | | | | | |

| | | |

| Standard Label | Preferred Label | |

| Date Context | | 20X3-01-01 to 20X3-12-31 |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | http://fasb.org/us-gaap/20X3#AccountingStandardsUpdate20XXX6Member |

| XL24 | Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration] | full retrospective transition approach | http://fasb.org/us-gaap/20X3#AccountingStandardsUpdate20XXX6RetrospectiveMember |

Figure 7.3b

Notes:

•In this example, “Change in Accounting Principle, Accounting Standards Update, Early Adoption [true false]” (L23) is used instead of “Change in Accounting Principle, Accounting Standards Update, Adopted [true false]” because the filer early adopted the amendment from the ASU. If the filer adopted the amendments from the ASU upon its effective date, then “Change in Accounting Principle, Accounting Standards Update, Adopted [true false]” would be used.

•An extensible enumeration element is used to convey the amendment from one ASU. “Accounting Standards Update [Extensible Enumeration]” (XL2) is used to tag the fact value indicating which amendment from an ASU is affecting the financial statements. If a filer reports values from amendments from more than one ASU within the filing in the same reporting date context, then the “Accounting Standards Update [Axis]” (A4) is intended to be used.

•ASU 20XX-X6 is assumed to be adopted with a retrospective transition method in this example. “Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration]” (XL24) is used to tag the fact value indicating which transition option is elected only when there is a choice in transition options.

Example 8—Disclosure of Expected Impacts of ASU—Cumulative Effect in Period of Adoption

This example illustrates the modeling for disclosures reporting information about the expected impacts of amendments from an ASU with the cumulative effect in the period of adoption transition method (also known as the modified retrospective transition approach in this example). In a note on recently issued accounting standards, ABC Company discloses information related to the adoption of Accounting Standards Update 20XX-X7.

Effective January 1, 20X4[1], ABC Company will adopt ASU 20XX-X7[2] using the modified retrospective transition approach[3] as of the period of adoption by recording a cumulative effect adjustment to decrease retained earnings by $5 million[4] to $10 million[5]. The Company does not expect the adoption to have a material effect on operating results.

_____________________________

Legend†:

†This legend, which is not part of the disclosure, is provided to illustrate the elements associated with values reported.

[1] L22, A5:M15 January 1, 2026 [2] XL2, A5:M15

[3] XL24, A5:M15 [4] L1, A1:M3, A3:M11, A5:M15, A6:M16

[5] L1, A1:M3, A3:M11, A5:M15, A6:M17

Figure 8.1

The legend for the elements used to tag these facts follows:

| | | | | | | | | | | | | | |

| Standard Label | Balance Type | Period Type | Element Name |

| A1 | Equity Components [Axis] | | Duration | StatementEquityComponentsAxis |

| Equity Component [Domain] | | Duration | EquityComponentDomain |

| M3 | Retained Earnings [Member] | | Duration | RetainedEarningsMember |

| | | | |

| A3 | Cumulative Effect, Period of Adoption [Axis] | | Duration | CumulativeEffectPeriodOfAdoptionAxis |

| Cumulative Effect, Period of Adoption [Domain] | | Duration | CumulativeEffectPeriodOfAdoptionDomain |

| M11 | Cumulative Effect, Period of Adoption, Adjustment [Member] | | Duration | CumulativeEffectPeriodOfAdoptionAdjustmentMember |

| | | | |

| A5 | Scenario [Axis] | | Duration | StatementScenarioAxis |

| Scenario [Domain] | | Duration | ScenarioUnspecifiedDomain |

| M15 | Pro Forma [Member] | | Duration | ProFormaMember |

| | | | |

| A6 | Statistical Measurement [Axis] | | Duration | RangeAxis |

| Statistical Measurement [Domain] | | Duration | RangeMember |

| M16 | Minimum [Member] | | Duration | MinimumMember |

| M17 | Maximum [Member] | | Duration | MaximumMember |

| | | | |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | Duration | AccountingStandardsUpdateExtensibleList |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | Credit | Instant | StockholdersEquityIncludingPortionAttributableToNoncontrollingInterest |

| L22 | Change in Accounting Principle, Accounting Standards Update, Adoption Date | | Instant | ChangeInAccountingPrincipleAccountingStandardsUpdateAdoptionDate |

| XL24 | Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration] | | Duration | ChangeInAccountingPrincipleAccountingStandardsUpdateTransitionOptionElectedExtensibleList |

Figure 8.2

The XBRL report views created using the modeling structure are provided here:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Standard Label | Preferred Label | | | | |

| Date Context | | 20X4-12-31 | |

| Scenario [Axis] | | Pro Forma [Member] | |

| A5 | | M15 | |

| Equity Components [Axis] | | Retained Earnings [Member] | | |

| A1 | | M3 | |

| Cumulative Effect, Period of Adoption [Axis] | | Cumulative Effect, Period of Adoption, Adjustment [Member] | |

| A3 | | M11 | |

| Statistical Measurement [Axis] | | Minimum [Member] | Maximum [Member] | |

| A6 | | M16 | M17 | |

| L1 | Equity, Including Portion Attributable to Noncontrolling Interest | retained earnings | -5000000 | -10000000 | | |

| L22 | Change in Accounting Principle, Accounting Standards Update, Adoption Date | | | | 20X4-01-01 | |

Figure 8.3a

| | | | | | | | | | | |

| | | |

| Standard Label | Preferred Label | |

| Date Context | | 20X4-01-01 to 20X4-12-31 |

| Scenario [Axis] | | Pro Forma [Member] |

| A5 | | M15 |

| XL2 | Accounting Standards Update [Extensible Enumeration] | | http://fasb.org/us-gaap/20X3#AccountingStandardsUpdate20XXX7Member |

| XL24 | Change in Accounting Principle, Accounting Standards Update, Transition Option Elected [Extensible Enumeration] | modified retrospective transition approach | http://fasb.org/us-gaap/20X3#AccountingStandardsUpdate20XXX7ModifiedRetrospectiveMember |

Figure 8.3b

Notes: